It is an event that has been dreaded by corporate executives for years. The pay ratio disclosure rule in the Dodd-Frank law is now being fully implemented, effective May, 2018. While Congress has chipped away many of the regulations of this law, it has retained the part that requires publicly traded companies to calculate and reveal the ratio between the CEO’s compensation and the median pay of the companies’ employees. This could be a huge challenge to the brand image for these chief executives and implicitly a risk for their company brand.

Income inequality had been growing for years. The share of total income earned by the top 10% has risen from around 31% in the 1970’s to about 50% today. Most of this income increase has come at the expense of workers in the lower half of the distribution. Their share of total income fell from 20% in the 1970’s to just over 10% today (source: “Deloitte Insights”). Perceptions reflect these facts, too. The 2017 Edelman Trust Barometer found that 74% of the U.S. population believe the gap between the wealthy and everyone else has increased over the past 10 years.

The SEC has long required companies to disclose executive pay, but what’s new is the requirement that they also have to own up to what they pay their rank and file in comparison. And these ratios can be stark and very embarrassing. For example:

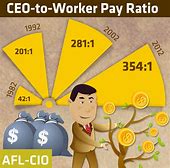

- Equilar, an executive compensation consulting firm, studied the 200 highest paid CEOs and found that their median pay was $17.5 million, which increased by 14% in 2017, by 9% the year before and 5% in 2015. In contrast the median compensation for their workers was $75,217, so the pay ratio was 275 to 1.

- The AFL-CIO reported that for more than 400 companies in the S&P 500, the average CEO made 347 times more than the average worker.

- The median pay for a Walmart employee was $19,177 in 2017 compared to $22.2 million for its CEO, and so this employee would have to work over a thousand years to earn the same.

In a 2017 poll of 360 corporate executives and compensation professionals by Willis Towers Watson, a global consulting firm, 49% of U.S. companies said their biggest challenge will involve projecting how their employees will react to these ratio disclosures. Related to this is how to craft their required disclosure (37%), since there are different extenuating circumstances that affect the ratio for each company – e.g. use of outsourced labor, lower wages for employees overseas, parts of compensation in stock, etc. What is especially disconcerting is that almost half (48%) of these companies had yet to determine how they would communicate their pay ratio to employees.

Today it represents a potential time bomb for new threats and reputational damage not just from employees, but also from customers, shareholders, the media and even investors. This socio-economic issue of income disparity is already a prominent cause for social activism as well, and this new pay ratio rule will only add to their fury. It is very likely that activists will use these new, more vivid disclosures to create a major backlash, including protests on social media, possibly even boycotts.

Because a company brand is often defined by the image and values of its CEO, the overall brand risk will be intensified as a result. Examples of visibly dominating corporate leaders who have shaped the culture of their company are Howard Schultz of Starbucks and Stephen Wynn of Wynn Resorts (his 2017 compensation of $35.5 million is 909 times greater than the median employee pay of $37,963)

On the other hand the public visibility of many CEOs can provide an opportunity to take preemptive initiatives to re-brand themselves and/or their company, and even help prevent attacks from activists. There are several options that can minimize the risks to their company brand. Increasing the compensation commensurately of workers would be an obvious solution (i.e. Walmart is doing this now), especially with the added profits from the recent tax cut. Other considerations include starting a new dialogue with employees, customers and shareholders on pay transparency, and even proactively contributing parts of their compensation package to programs to improve society and create a more purpose-driven brand image for their company (more on this in my next blog). At a minimum, chief executives cannot ignore the possible risks to their brand from demoralizing trends like growing income disparity, and should at least assess and identify their vulnerabilities.